#INTUIT MINT SAFE INSTALL#

To protect your account, Mint suggests that you create strong passwords, never share your passwords, use virus protection and a firewall on your computer, and don’t install programs from unknown sources. “In my mind, it’s been in maintenance mode the last eight years,” says Aaron Patzer, the founder of Mint who accepted Intuit’s offer, found himself tasked with improving Quicken, and then left the company in 2012. Goal setting: If you know Dave Ramsey, you know he is big on paying off debt and building positive momentum toward a more secure financial future. KeyBank provides a secure, reliable way to share data with services and apps. Mint, which comes from the makers of TurboTax and QuickBooks, also uses multi-factor authentication. But more than a decade after the firm behind TurboTax and QuickBooks (and, until 2016, Quicken) bought Mint for $170 million, neatly taking a competitor off the map, this once-groundbreaking app might as well be streaked with cobwebs. Intuit bought Mint in 2009 and still owns it.

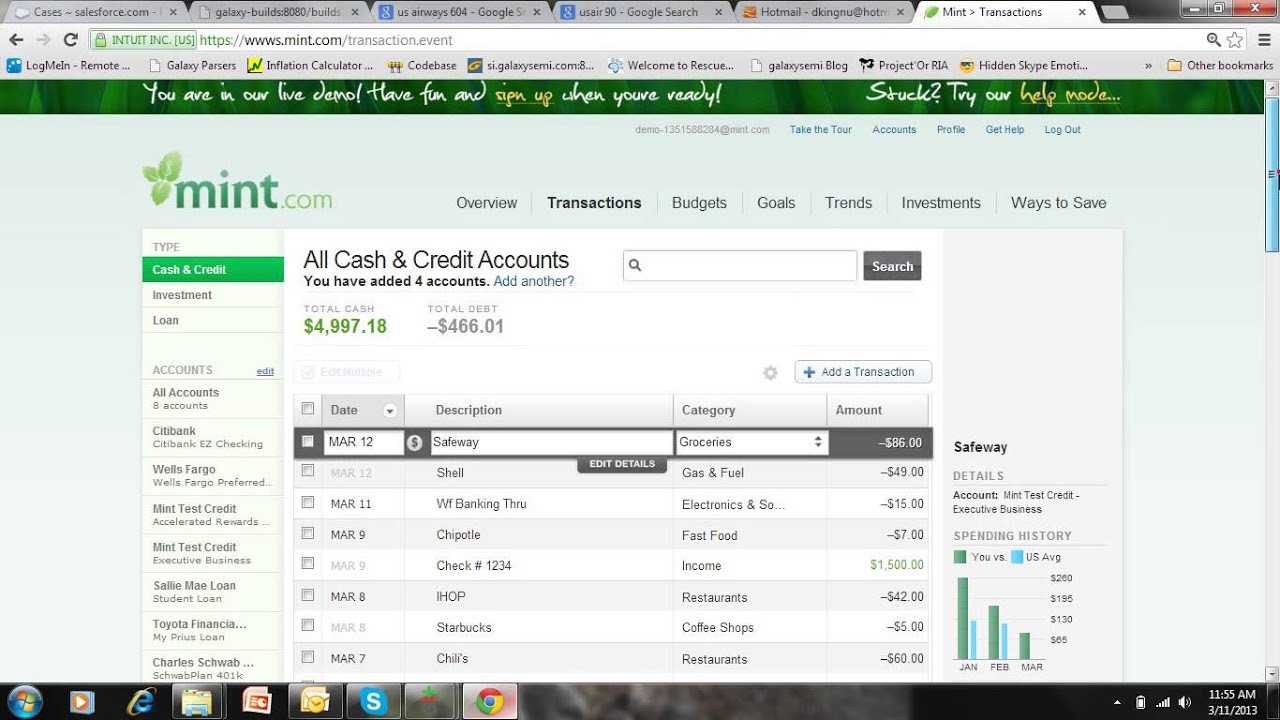

Both Quicken and Mint were owned by Intuit at one point. It’s as if Mint, with 13 million-plus registered users, were a resource-constrained startup instead of a property of Intuit, the Microsoft of personal finance. Mint Mint launched in 2006 and was quickly dubbed the 'Quicken killer.' Unlike Quicken, Mint instantly synced all your banking and credit card accounts so that you can see your finances in real-time from anywhere.

#INTUIT MINT SAFE TV#

Many transactions still show up without being cleansed from the all-caps raw feed of a credit-card statement: “SLING TV – ENGLEWOOD, CO,” not “Sling TV.”.

0 kommentar(er)

0 kommentar(er)